Provider Pulse – January 2023

2023 VA Fee Schedule Now Available

2023 VA Fee Schedule Now Available

The 2023 Department of Veterans Affairs (VA) Fee Schedule (VAFS) is now published with a new yearly cycle adjustment.

Beginning in 2023, the VAFS cycle will run February 1 to January 31. VA adjusted the yearly fee schedule cycle to ensure rate settings take into account comprehensive data from other industry sources.

To accommodate the adjustment in timing, the Calendar Year 2022 VA Fee Schedule-All Payers will run through Jan. 31, 2023, service dates. The 2023 VAFS will cover services beginning Feb. 1, 2023.

VA reimburses medical services, hospital care and extended care services up to the maximum allowable rate. The maximum allowable reimbursement rate is generally the applicable Medicare rate published by the Centers for Medicare and Medicaid Services. When there is no Medicare rate available, VA reimburses the lesser of VAFS or billed charges.

VA continues to modernize the reimbursement methodology to ensure maximum allowable VAFS rates are consistent with industry reimbursement benchmarks and ensure that most services have maximum allowable rates. The goal of VAFS is to ensure fair reimbursement for all providers when Medicare maximum allowable rates are not available.

Reimbursement rates are subject to change.

More information for providers can be found at the VA Fee Schedule webpage.

Veteran Coverage for Acute Suicidal Crisis Expands: COMPACT Act Update

Veteran Coverage for Acute Suicidal Crisis Expands: COMPACT Act Update

As a result of the Veterans Comprehensive Prevention, Access to Care, and Treatment Act of 2020, otherwise known as the Veterans COMPACT Act of 2020, Veteran coverage for acute suicidal crisis care is expanding. Emergent suicide care for eligible Veterans in acute suicidal crisis at a VA or non-VA facility is a covered benefit. This means that Veterans meeting certain eligibility criteria are eligible for urgent care or emergent care if in an acute suicidal crisis.

Regardless of VA enrollment status, eligible Veterans are:

- Those who were discharged or released from active duty under conditions other than dishonorable after more than 24 months of active service;

- Former members of the armed forces, including reserve service members, who served more than 100 days under a combat exclusion or in support of a contingency operation either directly or by operating an unmanned aerial vehicle from another location who were discharged or released under a condition that is other than dishonorable; or

- Former members of the armed forces who were the victim of a physical assault of a sexual nature, a battery of a sexual nature, or sexual harassment while serving in the armed forces.

For emergent suicide care, the presenting individual/Veteran does not have to be enrolled in VA health care nor are they restricted to having received VA health care benefits. Reporting emergency episodes to VA as soon as possible is imperative because VA must verify a Veteran’s eligibility for emergent suicide care if they are not already enrolled or registered.

Guidelines for Emergency Providers:

- Report emergency treatment through VA’s Emergency Care Reporting (ECR) portal, or by calling 844-72HRVHA (844-724-7842).

- Contact the local VA medical center (VAMC) to coordinate any follow-up care and transfer activities, if necessary. VA will provide referrals with the appropriate Standard Episode of Care (SEOCs).

Covered costs include transportation and referral to appropriate support following the emergent suicide treatment for up to 30 days of inpatient care or 90 days of outpatient care. VA will also refer eligible Veterans for appropriate VA programs and benefits following the period of emergent suicide treatment.

The following guidelines apply to urgent care under the COMPACT Act:

- Individuals and Veterans seeking care under the COMPACT Act at Retail or Urgent Care locations without confirmed Urgent Care eligibility will be responsible for the initial cost for care.

- It is the provider’s responsibility to inform individuals and Veterans without UC eligibility that they can pursue reimbursement for their care from VA. The Veteran should submit their bill to VA: https://www.va.gov/COMMUNITYCARE/programs/veterans/File-a-Claim.asp.

- Network providers do not have the authority to determine eligibility under the COMPACT Act.

If the Veteran does not have eligibility code of U:

- Do not process the claim for payment under CCN.

- Inform the Veteran that they may be eligible for reimbursement from VA.

- Share the VA website for Veteran information: https://www.va.gov/COMMUNITYCARE/programs/veterans/Emergency-Care.asp

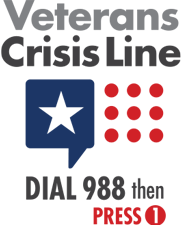

- Provide the Veteran with the Suicide & Crisis Lifeline (988) and information to press 1 to reach the Veterans Crisis Line.

- Proceed with billing process as previously established.

For more information see the TriWest CCN Urgent Care & Emergency Care Quick Reference Guide.

Alaska Professional Claims Pricing Utilizing 2021 Fee Schedule

Alaska Professional Claims Pricing Utilizing 2021 Fee Schedule

The Department of Veterans Affairs (VA) has requested TriWest Healthcare Alliance to price Alaska Patient-Centered Community Care (PC3) claims with dates of service from January 1, 2021, to December 31, 2021, utilizing the CY21 VA All Payers fee schedule.

Claims received on or before June 6, 2021, prior to PGBA transition may have been priced according to the Alaska Professional Claims in error.

Below are steps on how Alaska Professional Claims should apply for VA fee scheduling:

- Visit the VA fee schedule web page.

- Select the blue Historical Fee Schedules drop-down option.

- Download the CY21 VA Fee schedule-All Payers file.

- Once downloaded, filter by Medicare carrier and locality (Alaska is carrier 02102; locality 01).

As a reminder, PGBA prices CCN professional claims on the below fee schedules:

- Alaska Professional Fee schedule, if not present.

- VA Fee schedule – All Payers, if not present.

- Maximum Allowable Charge – If not present, service is denied.

Note: While the previous VA fee schedule for CY20 was based on the VAMC station ID, the new fee schedule is based on provider locality.

Medical Unlikely Edits Claims Payment Guidelines Can Reduce Improper Payments

Medical Unlikely Edits Claims Payment Guidelines Can Reduce Improper Payments

TriWest applies Medically Unlikely Edits (MUE) for claims payments using Medicare guidelines.

A Healthcare Common Procedure Coding System (HCPCS)/Current Procedural Terminology (CPT) code’s MUE is the maximum units of service that a provider would report under most circumstances for a single patient on a single date of service.

An MUE is used by the Medicare Administrative Contractors to reduce improper payments. It is the maximum unit of service a provider would report for a single date of service. Not all HCPCS/CPT codes have an MUE. If there is no MUE, or if the MUE is zero, TRICARE’s unit thresholds will apply to TriWest’s processed CCN claims when available.

For additional information visit the Centers for Medicare & Medicaid Services (CMS) Medicare NCCI MUEs, or the Health.mil Limits on Number of Services web page.

Home Health Agencies May Resume Care after Hospital Discharge

Home Health Agencies May Resume Care after Hospital Discharge

If a Veteran is admitted to a hospital and discharged during a Home Health episode of care, that same agency may resume care under the same authorization as long as the care needed does not exceed what is allowable by the Standardized Episodes of Care (SEOC).

If it is determined that a new plan of care will be needed that exceeds what is authorized by the SEOC while the Veteran is inpatient, an urgent Request for Service (RFS) must be submitted to the local Department of Veterans Affairs Medical Center prior to discharge.

As a reminder:

- All care must be pre-authorized.

- TriWest is required by contract to follow Medicare billing practices.

For more information refer to the Home Health Quick Reference Guide or visit the Home Health Care Services section of the TriWest CCN Provider Handbook.

Tell Us How We’re Doing – Complete a Survey

Tell Us How We’re Doing – Complete a Survey

Thank you for serving our nation’s heroes as a health care provider under the Department of Veterans Affairs (VA) Community Care Network (CCN).

Your feedback is valued. Each quarter we offer VA’s survey, which is required to be made available to providers who submitted one or more claims during the previous quarter. Individual responses remain confidential to VA. Your input will help VA continue to improve your experience and better serve our nation’s heroes.

If you are a network provider and submitted a claim in the last quarter, please take a few moments to provide your valued feedback and participate in the survey:

Complete the VA Provider Satisfaction Survey.

Follow These Resubmission Guidelines for Accurate Claims Submissions

Follow These Resubmission Guidelines for Accurate Claims Submissions

Get your claims submitted successfully, and improve your submission accuracy and payment timing.

If a claim was denied because it was sent to another VA payer, claims must be resubmitted for consideration within 180 days of VA’s or VA payer’s denial. VA payers include TriWest, Optum, or VA.

When resubmitting claims, follow these instructions to avoid the automatic timely filing denials:

- Retain a copy of the remittance advice from the original submission to the wrong entity. This documentation serves as proof of timely filing and should be retained to confirm the original submission date, in the event of an audit.

- For VA CCN claims:

- You must submit a paper claim. Per VA directives, there is no electronic option for CCN reconsideration requests:

- Print and complete the Provider Timely Filing Attestation Form located on TriWest’s Payer Space on Availity.

- Submit the form with the paper claim to PGBA.

- For PC3 claims ONLY:

- Option 1 - Submit an electronic claim via EDI:

- Use an indicator “9” on the 837 in the data element field CLM20 to indicate resubmission for timely filing. The “9” indicator definition is ‘Original claim rejected or denied for reason unrelated to the billing limitation rules.’

- Option 2 - Submit a paper claim:

- Print out and complete the Provider Timely Filing Attestation Form on TriWest’s Payer Space on Availity. Complete and submit the form with the paper claim to PGBA.

- Option 1 - Submit an electronic claim via EDI:

- You must submit a paper claim. Per VA directives, there is no electronic option for CCN reconsideration requests:

- For VA CCN claims:

Claims will be denied if they do not meet the above requirements. Remittance advice documentation from non-VA payers, such as TRICARE, Medicare, or other health insurers will not be accepted.

Please be advised: There are only two reasons an exception can be made to the timely filing requirement:

- A claim was first submitted to the incorrect VA payer (VA or Optum) and is received by TriWest within 180 days of the other denial.

- The VA referral was updated and the claim is submitted within 180 days of the referral update.

Tell Us Your Story!

Tell Us Your Story!

Do you have an inspiring story to tell about what it means to provide care for a Veteran? TriWest is looking to hear positive and uplifting stories about caring for our nation’s heroes for upcoming feature articles.

If you are interested in sharing your personal story of caring for Veterans and being featured in a future article, send us an email at TWnews@triwest.com.

Provider Handbook Updates

Provider Handbook Updates

There are several upcoming changes to the Billing and Claims Submission section of the CCN Provider Handbook.

NEW section on VA’s Community Care Network Guidelines

Community Care Network

TriWest Healthcare Alliance, on behalf of the U.S. Department of Veterans Affairs (VA), is the third-party administrator (TPA) and payer for the following networks:

- Community Care Network (CCN) Region 4

- Community Care Network (CCN) Region 5

TriWest has partnered with PGBA to process and pay out claims to CCN providers who have rendered services to Veterans in accordance with an authorized VA referral. It is a contract requirement that all CCN claims process electronically, regardless of the submission method. Therefore, filing claims electronically is preferred and encouraged. If you choose to submit paper claims, they must scan to an electronic format, creating a potential issue for handwritten or manually typed claims. Claims that cannot be scanned cleanly may reject.

PGBA only reviews claims that have an approved VA referral/authorization. An approved referral/authorization from VA should:

- support the service rendered by a CCN provider

- have a specific plan of care

- detail a specified number of visits and/or services related to a Standard Episode of Care (SEOC).

NEW section on billing guidelines for services rendered to Veterans

Billing for Services Rendered to Veterans

- All care requires an approved referral/authorization with the exception of urgent care. A claim submitted without a VA referral/authorization number will be denied.

- Providers should not collect copays, cost-shares or deductibles. CCN reimburses up to 100% of the allowed amount, including any patient

- Payments made by TriWest or VA shall be considered payment in full under CCN. Providers may not impose additional charges to TriWest or the Veteran for covered services.

- Providers are required to share the VA referral/authorization number with ancillary providers included in a Veteran’s episode of care. The ancillary provider is also required to use this same VA referral/authorization number when submitting their claim for the specific episode of care.

- For CCN, TriWest follows Medicare billing guidelines, fee schedules, and payment methodology when applicable.

- Remember, providers are not allowed to balance bill Veterans or TriWest for services provided under the CCN contract, including any remaining balances or after a timely filing denial.

Out-Of-Network Billing

Providers should always include the original VA referral number from the approved referral/authorization when billing TriWest.

If out-of-network providers do not know the original referral/authorization number, they should contact the CCN provider who received the approved referral/authorization to acquire it.

Out-of-network providers must submit health care claims directly to TriWest by billing PGBA, TriWest’s claims processor. Medical documentation related to care should be submitted to VA, preferably through HSRM, VA’s secure, web-based system used to generate and submit referrals and authorizations to community providers.

Under CCN regulations, payment from TriWest is considered payment in full from VA, and out-of-network providers are never allowed to balance bill a Veteran. The scope of care provided to a Veteran by an out-of-network provider must be included on an approved CCN referral/authorization.

UPDATED timely filing requirements

Time Limits on Claim Submissions

All authorized claims must be filed within 180 days from the date the service was rendered. Claims that are submitted beyond the 180-day limit will be automatically denied for timely filing without additional review (See 38 U.S.C. §1703).

If you disagree with a timely filing claim denial, you may request a review/informal appeal of that decision through the Claim Reconsideration Process discussed below.

Please note that you must have sufficient evidence that the claim being reviewed was originally submitted within the timely filing limits.

Exceptions to Timely Filing

If you have a claim that was denied for timely filing, and it meets ALL of the requirements below, you may submit a corrected claim using the “Timely Filing Exception Instructions.” This will ensure your corrected claim is properly submitted and will be processed as an exception to the timely filing requirements.

Requirements for submitting a corrected claim:

- TriWest denied your claim(s) because it exceeded the 180-day timely filing deadline.

- Your original claim submission was TIMELY filed with VA, Optum, or TriWest.

- You have documentary evidence to validate your original claim(s) was TIMELY filed with the wrong VA payer entity.

Timely Filing Exception Instructions

For Paper Claims: Print out and complete the Provider Timely Filing Attestation form on TriWest’s Payer Space on Availity, and submit with your paper claim to the address listed on the form (Florence, SC).

If you are resubmitting a claim through this process, please note the following:

- Claims that do not meet the above requirements will be denied.

- TriWest can no longer accept remittance advice documentation from non-VA payers, such as TRICARE, Medicare, or other health insurers.

- DO retain your original remittance documentation as proof of timely filing in the event of an audit.

- DO ensure that you have a valid VA referral on file for the services and include it on the claim submission.

NEW section on corrected/void claims

Corrected/Void Claims

A Corrected Claim should be submitted when you need to replace or correct information on a claim that was previously submitted and/or processed by PGBA. Submitting a Corrected Claim will have the effect of completely replacing your previously filed claim with the information on the corrected claim.

Examples of a corrected claim include (but are not limited to):

- Providing a referral number or rendering NPI originally omitted

- Changing procedure or diagnosis codes, or the patient’s name or demographic information, or any other information that would change the way the claim was originally processed.

Submit a void claim when you need to cancel a claim already submitted and/or processed by PGBA. See Corrections and Voids - Community Care (va.gov).

How to File a Corrected/Void Claim

Corrected claims can be submitted electronically as an EDI 837 transaction with the appropriate frequency code. For more details, go to Corrections and Voids - Community Care (va.gov).

When correcting information on 837 institutional claims, use bill type xx7, Replacement of Prior Claim or bill type xx8 to void a previous claim.

When correcting a paper CMS 1500 professional claim, use the following frequency codes in Box 22 and use left justified to enter the code. Include the 12-digit original claim number under the Original Reference Number in this box.

- Frequency code 7: Replacement of Prior Claim: Corrects a previously submitted claim.

- Frequency code 8: Void/Cancel of Prior Claim: Indicates this bill is an exact duplicate of an incorrect bill previously submitted. This code will void the original submitted claims.

NEW section on claims reconsiderations

Claim Reconsideration

Submit a Claim Reconsideration when you need to dispute the outcome of a claim previously submitted and processed. It is appropriate to submit a claim reconsideration when you believe the information originally submitted was complete and accurate (to your knowledge), but you disagree with the claim determination and are requesting a secondary review.

If you are submitting additional or different information that was NOT included in the original claim submission which resulted in a denial or payment discrepancy, please DO NOT submit a Claim Reconsideration Request. Any changes to a previously submitted and or processed claims should be filed through the corrected claims process (See above).

How to File a Claim Reconsideration

To submit an appeal, download TriWest’s Claims Reconsideration Form, available under the “Resources” tab on the TriWest Payer Space on Availity.

Providers wishing to submit a Claim Reconsideration must submit separate appeals for each disputed item.

NEW section on claims status

Claim Status Check Online

Providers can check the status of claims through Availity. The tool gives providers a more intuitive and robust workflow to check the claim status of Veteran patients. Log in to Availity and then click on the Claims & Payments option located on the top-left corner of the main screen. Under Claims & Payments, select the Claim Status option. The Claim Status tool allows providers to check the status of a submitted claim and view remittances.

Providers can also search claims by:

- Member ID

- Tax ID

- Service date

- Claim number

If providers cannot find a claim, there may have been errors with the submission. If providers can see a claim, it is in process. Please do not resubmit for in-process claims.

For missing claims, please verify that:

- It has been at least 10 business days since you uploaded the claim or 15 business days since the provider mailed the claim.

- A paper claim was not handwritten and all information was typed

If you have problems checking your claims status, visit Availity to use the secure “Chat with TriWest” feature, or call TriWest Claims Customer Service at 877-CCN-TRIW (877-226-8749) from 8 a.m. to 6 p.m. in your time zone.

NEW section on automatic claims status reports

Automatically Receive Claims Status Reports

TriWest now offers you the ability to self-subscribe and receive claims status reports emailed directly to your inbox. Reports can be automatically generated monthly, weekly or on an ad hoc date range based on your preference.

To subscribe, log in to your Availity account. Then:

- Select the Payer Spaces tab.

- Choose TriWest Healthcare Alliance.

- Select Provider Claims Reporting Tool.

- Select your Tax ID number.

- Click Add New Subscription.

- Select the frequency you prefer and enter the email address(es) where the reports should be delivered. (Note: Reports can be sent to up to five email addresses at a time.)

For a more detailed look at the Provider Claims Reporting Tool, refer to the Provider Claims Reporting Tool User Guide that displays screenshots on how to subscribe.